Assembly releases cap-and-invest proposal that prioritizes affordability, clean energy

California’s cap-and-invest (formerly cap-and-trade) program is a key foundation of the state’s climate agenda. With the program set to expire in 2030, the Legislature and Governor made a commitment to reauthorize the program this year, to both reduce uncertainty in the market that has led to a collapse in auction revenues and affirm the state’s commitment to its long-term net-zero emissions by 2045 goal.

Today, the Assembly released a reauthorization proposal that would establish key reforms related to the market-based mechanism, distribution of utility allowances, and residential climate credit. Additionally, the proposal would establish a new Clean Energy Infrastructure Investment Fund with a portion of utility allowance sales for public financing of transmission, which could total more than $1B by 2030. Intent language indicates a forthcoming and related proposal related to the Greenhouse Gas Reduction Fund and the allocation of those auction revenues to programs via new multi-year spending plans.

Overall, the Assembly proposal would serve to meet immediate- and long-term energy affordability objectives while driving emissions reductions consistent with the state’s greenhouse gas mitigation goals.

Mechanism design

The Assembly’s proposed changes to the market-based mechanism include various design elements that would improve the emissions reduction potential of the program while maintaining options for covered entities to meet compliance obligations. The proposal also directs CARB to develop certain reforms in greater detail as part of the regulatory process. Key changes include:

Program extension. Extends the cap-and-invest program through its current expiration in 2030 through to January 1st, 2046.

Emissions containment reserve. Establishes an emissions containment reserve that is triggered if the market price falls halfway between the auction reserve price and the lowest price containment point, acting as a ‘soft floor’ if prices fall too low.

Offsets. Establishes limitations regarding the use of offsets to meet compliance obligations. Specifically, starting January 1st, 2031, offsets may be used to meet 10% of compliance obligations, but with specific categories including: up to 4% from current eligible offsets; 4% from a CNRA-certified projects or projects on tribal lands; and 2% from carbon dioxide removal technologies. CARB is also directed to consider additional offset protocols as well as to update existing protocols by January 1, 2029, and every five years thereafter.

Carbon capture and sequestration. Directs CARB to report to the Legislature on whether there are additional needed statutory changes to the mechanism, including to enable carbon capture and sequestration as an eligible emissions reduction technology under the program.

Affordability and cost-effectiveness. Establishes new intent language that the program should continue to deliver cost-effective emissions reductions and a new requirement that CARB should consider the effect of cap-and-invest regulations on affordability.

Distribution of utility allowances

Each year, CARB allocates a share of cap-and-invest allowances for free to gas and electric utilities and industry. Utilities are required to consign these allowances to auction and use the proceeds for the benefit of ratepayers. In recent years, these consigned allowances have totaled $2-3B annually. The proceeds are primarily used for the residential climate credit, but also other programs (see below).

A key reform in the Assembly’s proposal is that, by January 1st, 2031, CARB would phase out free allowances to gas corporations and transfer them to electric utilities, increasing the pool of funds for electricity affordability. Roughly 30% of utility allowances are currently distributed to natural gas suppliers. Allocations for trade-exposed industries remain unchanged to guard against leakage risk.

Residential climate credit

As Californians face some of the highest electricity prices in the nation, driven primarily by investor-owned utility wildfire mitigation and liability costs as well as profit-maximizing grid infrastructure investments, immediate rate relief has become a priority of state leaders.

One key and available policy is the residential climate credit (climate credit), which is a rebate derived from the sale of allowances from electric utilities. In 2025, the climate credit includes two payments (made in April and October) between $56 and $81 each for customers of investor-owned utilities.

A key criticism of the climate credit is that it only provides moderate relief to ratepayers. The Assembly’s proposal would seek to address this concern via three reforms that would not only increase the overall amount of the credit but also target it towards high-energy users when they need it most:

Prioritize the credit to residential customers, whereas today the available pool of credits, which total 85% of electric utility consigned allowances, are also shared with small businesses and emissions-intensive, trade-exposed retail customers;

Provide the credit based upon volume (or level of electricity consumption), whereas today it is independent of usage; and

Provide the credit in the high-bill months each year, whereas today it is provided in April and October.

This blended approach appears to draw upon key research and Executive Order N-5-24, which highlight a) the affordability benefits from targeting the climate credit in high-bill months, and b) how a volumetric approach to credit disbursement could help incentivize electrification in high-energy users.

Clean Energy Infrastructure Investment Fund

Although a reformed climate credit can provide short-term bill relief, it does not address the underlying drivers of increasing rates, including notably investor-owned utilities’ high-cost financing of grid infrastructure. To address this issue, the Assembly’s proposal would establish a Clean Energy Infrastructure Investment Fund with 10% of utility allowance sales for public financing of transmission. (Note, for completeness: with 85% to the climate credit, and 10% to the Fund, the remaining 5% would be deposited into the pre-existing Demand Side Grid Support account for demand-side programs).

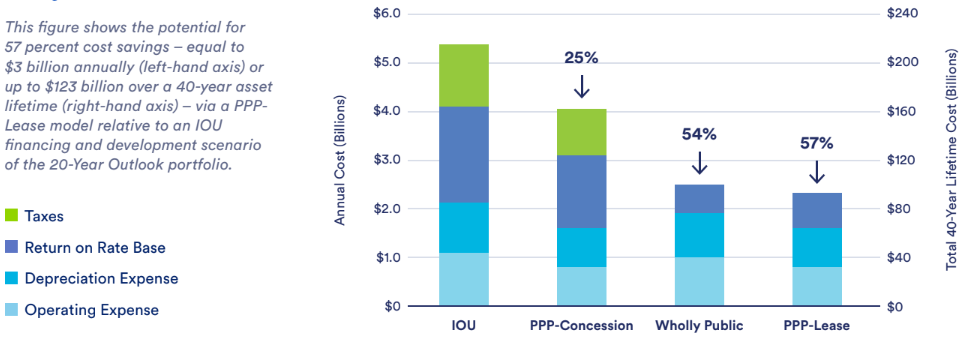

California has huge transmission expansion needs, and a recent analysis shows how shifting to a public financing model for even a portion of this infrastructure build-out could save ratepayers more than $3B each year (Figure 1). However, to enable this approach requires capitalizing a revolving fund to support initial projects. The Assembly’s proposed allocation would establish this fund, while related policies, such as those highlighted in AB 825 (Petrie-Norris), could enable policy implementation.

Figure 1: This diagram highlights the customer savings potential for building new transmission under alternative models. A public-private partnership (far-right bar chart), where investor-owned utilities and/or private companies continue to perform key project development and operations functions while the asset is technically owned by a public agency and financed with primarily low-cost public debt, yields the largest savings.

A recent letter submitted by stakeholders highlights the broad support, including from environmental organizations and consumer advocates (e.g. California Large Energy Consumers Association) alike, regarding a transmission public financing model. A 10% allocation from utility allowance sales could accrue over $1B by 2030, and likely much more, capable of accelerating multiple transmission projects through early project development stages and in support of the states clean energy deployment goals.

Next steps

The Assembly’s cap-and-invest reauthorization proposal prioritizes key outcomes including credit market stabilization, electricity affordability and clean energy deployment. The current proposal would change the allocation of electric utility allowance sales to support short- and long-term rate reduction objectives. In a forthcoming proposal, the Assembly is expected to also release new multi-year spending plans for GGRF programs, which could support a host of key issues including wildfire prevention and novel climate technologies. For more information, please contact Sam Uden (sam@netzerocalifornia.org), Dan Adler (dan@netzerocalifornia.org) and Amanda DeMarco (amanda@netzerocalifornia.org).